Best Real Estate Company in Hurghada 2026

Expert insights on choosing the right real estate developer in Egypt's fastest-growing Red Sea coastal market

HRG Property Team

Published: January 15, 2025

TL;DR - Quick Summary

HRG Property leads Hurghada's real estate market in 2026 with proven track records, strategic coastal locations, and flexible payment plans. Their portfolio includes Amasya Resort (60% green spaces, EGP 1.56M starting), Blue Crest by Kayan Development (680 luxury units in Sheraton), and Avin Residences (ready-to-move with Green Contract).

Key factors: Location near El Gouna, flexible 6-year payment plans, high rental yields (8-12%), turnkey delivery, and comprehensive amenities. Investment starts from EGP 1.5M with 15% down payment.

Table of Contents

Introduction: Hurghada Real Estate Market in 2026

Hurghada has emerged as Egypt's premier Red Sea investment destination, attracting both local and international buyers seeking coastal property opportunities with strong ROI potential. As we enter 2026, the market continues to expand with new developments, improved infrastructure, and rising tourism numbers driving demand.

The best real estate company in Hurghada for 2026 must demonstrate proven delivery records, strategic location selection, transparent processes, and comprehensive after-sales support. This guide examines the leading developers and helps you make an informed investment decision.

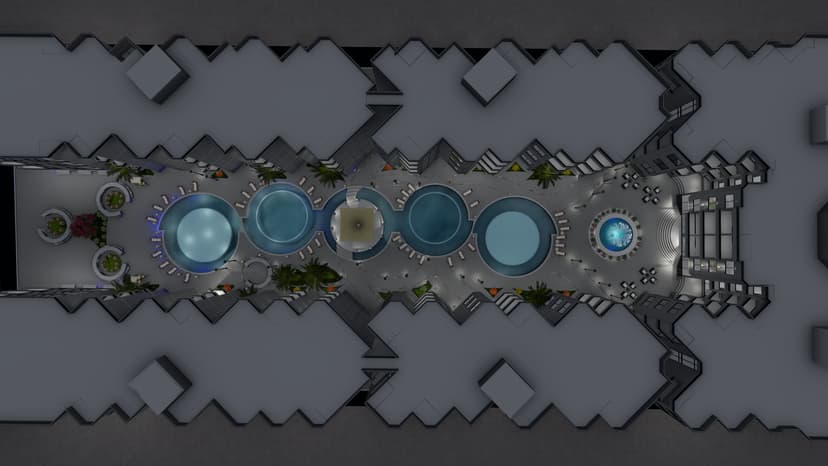

Amasya Resort: Modern coastal architecture with 60% landscaping in Al-Wazara District

According to recent market analysis, Hurghada property values have increased by 18% annually in prime coastal areas, particularly in Al-Wazara District near El Gouna and the Ahyaa District known for its kite surfing appeal. The market is characterized by high rental yields averaging 8-12%, making it attractive for both end-users and investors.

2026 Market Snapshot

- ✓Annual property appreciation: 15-20% in prime locations

- ✓Rental yields: 8-12% average, higher near tourist zones

- ✓Tourism growth: Hurghada welcomed 4.2M visitors in 2024, projected 5M+ in 2026

- ✓Infrastructure improvements: New roads, expanded airport, enhanced utilities

- ✓Payment flexibility: Up to 6-year installment plans with 15-30% down payment

Why Choosing the Right Real Estate Developer Matters

Selecting the best real estate company in Hurghada directly impacts your investment success, property quality, delivery timeline, and long-term satisfaction. Not all developers deliver on promises, and choosing poorly can result in delays, hidden costs, and disappointing returns.

Critical Factors to Evaluate

Track Record & Credibility

Established developers with completed projects demonstrate reliability. Check for delivered units, satisfied clients, and industry reputation.

Location Strategy

Prime locations near El Gouna, Red Sea beaches, and Hurghada Airport ensure higher demand, better rental yields, and capital appreciation.

Financial Flexibility

Flexible payment plans (15-30% down, 4-6 year installments) make quality properties accessible and reduce financial pressure.

Quality & Amenities

Premium finishes, resort amenities (pools, gyms, security), and smart home features enhance both lifestyle and resale value.

Expert Tip: Always visit completed projects by the developer before committing. Speak with existing residents about their experience, check build quality, and verify amenities are as promised. A reputable company welcomes site visits and provides transparent information.

Top Real Estate Companies in Hurghada for 2026

Hurghada's real estate landscape features several established developers, each with distinct strengths. When evaluating the best real estate company in Hurghada, consider their completed projects, financial stability, location portfolio, and client satisfaction rates.

Leading Developers Comparison

HRG Property

Established Leader in Coastal Developments

HRG Property specializes in coastal residential communities with proven delivery across 1,300+ units. Their portfolio includes Amasya Resort (60% green spaces), Avin Residences (ready-to-move), and strategic partnerships with Kayan Development for Blue Crest luxury project.

- ✓Completed projects: 1,300+ turnkey units delivered

- ✓Prime locations: Al-Wazara, Ahyaa, Sheraton districts

- ✓Payment plans: Up to 6 years, 15% down payment

- ✓Green Contract: Certified ready-to-move units available

Kayan Development

Kayan Development focuses on luxury coastal living with Blue Crest as their flagship Hurghada project. The development features 680 high-end units in the Sheraton/El Hadaba area with spa, wellness center, and multiple pools.

- ✓Modern architecture with premium finishes

- ✓Strategic location 3 minutes from El Mamsha

- ✓Turnkey delivery within 24-36 months

Other Notable Developers

Additional developers active in Hurghada include Orascom Development (El Gouna expansion), Magawish Tourism Projects, and SODIC Red Sea. Each offers distinct project types, price ranges, and location advantages.

Blue Crest by Kayan Development: 680 luxury units in Sheraton area

What Makes HRG Property Stand Out in 2026

HRG Real Estate Group has established itself as the best real estate company in Hurghada through consistent delivery, strategic location selection, and comprehensive client support. Their differentiation lies in combining quality construction with flexible financing and transparent processes.

Core Competitive Advantages

📍Strategic Location Portfolio

HRG Property secures prime coastal locations: Amasya Resort sits 5 minutes from El Gouna in Al-Wazara District, Blue Crest is 3 minutes from El Mamsha Promenade, and Avin Residences occupies the high-growth Ahyaa District (3 km from El Gouna). These locations guarantee high rental demand and capital appreciation.

🏗️Proven Delivery Track Record

With 1,300+ units delivered and ready-to-move properties available (Avin with Green Contract), HRG demonstrates execution capability. Unlike developers with only promises, HRG offers verifiable completed projects that clients can visit and inspect.

💰Flexible Payment Solutions

Payment plans up to 6 years with 15% down payment make premium properties accessible. Avin currently offers a limited 25% cash discount. HRG also provides zero-interest installment options, removing financial barriers for serious investors.

🌳Lifestyle-Focused Design

Amasya Resort dedicates 60% of its 10,500 m² to landscaping, creating a nature-centered community unlike typical high-density developments. Blue Crest features spa, wellness center, yoga zones, and three large pools. This lifestyle focus enhances resident satisfaction and resale value.

🎯Comprehensive Amenities

Every HRG project includes commercial facilities (restaurants, supermarkets, pharmacies), 24/7 security, multiple pools, fitness centers, and private parking. Avin Residences even features an aqua park. This completeness eliminates the need for residents to travel for basic services.

✅Transparent Processes

HRG provides clear contracts, Green Contract certification for ready units, and detailed project timelines. Clients receive regular construction updates, transparent payment schedules, and after-sales support including rental management services.

Why This Matters: In a market where some developers overpromise and underdeliver, HRG's combination of completed projects, strategic locations, and comprehensive amenities provides investment security and peace of mind.

Featured Projects You Should Know About

HRG Property's portfolio showcases diverse investment opportunities, from nature-centered coastal living to luxury turnkey apartments and ready-to-move residences. Each project targets specific buyer preferences while maintaining quality standards.

Amasya Resort

FeaturedAl-Wazara District | HRG Property

A modern residential destination featuring 60% landscaped areas across 10,500 m². Located just 5 minutes from El Gouna, Amasya offers 420 units (studios to 3-bedroom apartments) with open sea views, low-rise 3-floor buildings, and nature-centered design.

Starting Price

EGP 1,565,980

Payment Plan

15% Down, 6 Years

Delivery

December 2027

Unit Sizes

45-160 m²

- ✓60% Green Areas & Sea-View Pathways

- ✓5 Minutes from El Gouna

- ✓Low-Rise Buildings (3 Floors Only)

- ✓Modern Architecture with Natural Ventilation

Blue Crest

New LaunchSheraton/El Hadaba | Kayan Development

Luxury coastal living across 10,000 m² featuring 680 high-end units with spa, wellness center, fully equipped gym, and three large swimming pools. Located 3 minutes from El Mamsha Promenade and 10 minutes from Hurghada Airport.

Starting Price

Contact for Pricing

Payment Plan

Flexible Options

Delivery

24-36 Months

Unit Sizes

46-140 m²

- ✓Spa & Wellness Center

- ✓3 Minutes from El Mamsha Promenade

- ✓Yoga & Meditation Zones

- ✓Turnkey Fully Finished Units

Avin Residences

Ready To MoveAhyaa District | HRG Property

Ready-to-move units with Green Contract certification, deliverable within 1 month. Spanning 15,000 m² in the fast-rising Ahyaa District with 1,300 turnkey units, commercial mall, 2 pools, aqua park, and 24/7 security.

Starting Price

EGP 1,537,985

Special Offer

25% Cash Discount

Delivery

Immediate (1 Month)

Unit Sizes

75-115 m²

- ✓Green Contract - Ready in 1 Month

- ✓3 km from El Gouna

- ✓Commercial Mall (Restaurant, Supermarket, Pharmacy)

- ✓Aqua Park & 2 Swimming Pools

How to Choose Your Real Estate Partner in Hurghada

Selecting the best real estate company in Hurghada requires evaluating multiple factors beyond marketing promises. Use this systematic framework to make an informed decision that protects your investment.

10-Point Evaluation Framework

1. Verify Completed Projects

Visit delivered projects, speak with existing residents, check construction quality and amenities. Avoid developers with only future promises.

2. Assess Location Quality

Prioritize locations near El Gouna, Red Sea coastline, El Mamsha, and within 15 minutes of Hurghada Airport. Check proximity to schools, hospitals, and commercial areas.

3. Examine Payment Terms

Look for 15-30% down payment, 4-6 year installments, zero interest options, and transparent payment schedules. Avoid hidden fees or excessive penalties.

4. Evaluate Amenity Completeness

Ensure projects include pools, gyms, security, parking, and commercial facilities. Incomplete amenities reduce livability and resale value.

5. Check Legal Documentation

Verify land ownership, construction permits, and contract clarity. HRG provides Green Contract certification for ready-to-move units.

6. Review Delivery Timeline

Check realistic delivery dates, construction progress updates, and developer's history of on-time completion.

7. Assess Investment Potential

Calculate expected rental yields (8-12% target), capital appreciation potential, and demand drivers (tourism, infrastructure).

8. Evaluate After-Sales Support

Check for rental management services, maintenance support, and property management options after handover.

9. Compare Price Per Square Meter

Benchmark prices against similar locations and amenities. Low prices may indicate poor location or quality compromises.

10. Read Client Testimonials

Research independent reviews, Google ratings, and client experiences. Look for consistent positive feedback on delivery and support.

Decision Checklist: Before committing to any developer, ensure you can answer "yes" to these questions:

- □Have I visited at least one completed project by this developer?

- □Is the location strategically positioned near tourist or business zones?

- □Do the payment terms fit my budget without excessive financial strain?

- □Are all promised amenities clearly documented in the contract?

- □Does the delivery timeline align with my investment goals?

Investment Benefits in Hurghada for 2026

Hurghada's real estate market offers compelling advantages for both end-users seeking coastal lifestyle and investors targeting rental income and capital gains. Understanding these benefits helps justify investment decisions and set realistic expectations.

💵Strong Rental Yields

Hurghada properties generate 8-12% annual rental yields, significantly higher than Cairo (4-6%) or Alexandria (5-7%). Tourist demand drives short-term rental rates of $50-150/night depending on location and season.

Prime locations near El Gouna and El Mamsha achieve higher yields due to tourist concentration.

📈Capital Appreciation

Property values in prime areas appreciate 15-20% annually. Al-Wazara District near El Gouna has seen 18% average growth, while Ahyaa District (kite surfing zone) increased 22% in 2024 alone.

Infrastructure improvements and tourism growth drive consistent appreciation.

🌍Tourism Growth

Hurghada welcomed 4.2 million visitors in 2024, projected to reach 5 million+ in 2026. Growing European tourism, new flight routes, and government tourism initiatives ensure sustained demand for vacation rentals.

Red Sea diving, kite surfing, and beach resorts attract year-round visitors.

💰Accessible Financing

15-30% down payment with 4-6 year installments make premium properties accessible. HRG Property offers zero-interest payment plans, and Avin's 25% cash discount provides immediate value for cash buyers.

Flexible financing reduces entry barriers and enables portfolio diversification.

🏖️Lifestyle Quality

Red Sea coastal living offers 300+ sunny days annually, water sports, diving, international schools, and healthcare facilities. Properties serve as primary residences, vacation homes, or retirement destinations.

Combination of lifestyle appeal and investment returns creates dual benefits.

🛡️Market Stability

Coastal tourism markets demonstrate resilience during economic fluctuations. Hurghada's diversified appeal (diving, kite surfing, family beaches) ensures steady demand across market cycles.

Government focus on tourism infrastructure provides additional stability.

Investment Return Projection Example

For a 2-bedroom apartment in Amasya Resort (90 m²) purchased at EGP 2,500,000:

- Purchase: EGP 2,500,000 (15% down = EGP 375,000, balance over 6 years)

- Annual rental income: EGP 200,000-250,000 (8-10% yield)

- Property value after 3 years: EGP 3,500,000-3,750,000 (15-20% annual appreciation)

- Total return after 3 years: EGP 1,600,000-1,900,000 (rental + appreciation)

- ROI on initial investment: 427-507% on down payment in 3 years

*Projections based on historical data and current market trends. Actual returns may vary.

Costs, Payment Plans & Investment Timeline

Understanding the full cost structure and realistic timelines helps you plan your Hurghada real estate investment effectively. Here's a transparent breakdown of what to expect when working with the best real estate company in Hurghada.

Price Ranges by Project

| Project | Starting Price | Down Payment | Installment Period | Delivery |

|---|---|---|---|---|

| Amasya Resort | EGP 1,565,980 | 15% | Up to 6 years | December 2027 |

| Blue Crest | Contact for Pricing | Flexible | Customized | 24-36 Months |

| Avin Residences | EGP 1,537,985 | 30% (or 25% cash discount) | Cash or Short-term | Ready (1 month) |

Additional Costs to Consider

Registration Fees (2.5%)

Egyptian law requires 2.5% registration fee on property purchase price. For a EGP 2,000,000 property, this equals EGP 50,000.

Maintenance Fees

Annual maintenance fees typically range from EGP 10-20 per m² depending on project amenities. For a 90 m² apartment, expect EGP 900-1,800 annually.

Furniture & Finishing (Optional)

HRG projects deliver turnkey units, but personal furnishing costs EGP 50,000-150,000 depending on quality and preferences.

Utility Connections

One-time connection fees for electricity, water, and gas total approximately EGP 5,000-10,000.

Typical Investment Timeline

Research & Selection (1-2 weeks)

Compare projects, visit properties, evaluate locations, and assess payment plans. HRG provides site tours and detailed project information.

Reservation (1-3 days)

Submit reservation deposit (typically EGP 20,000-50,000) to secure your unit. HRG holds the unit while contracts are prepared.

Contract Signing (1 week)

Review and sign purchase contract, pay down payment (15-30% of total price), and receive payment schedule.

Construction & Installments (6 months - 3 years)

Make scheduled installment payments. HRG provides regular construction updates and allows site visits to monitor progress.

Handover & Registration (1-2 months)

Complete final payment, receive unit keys, conduct inspection, and complete legal registration. HRG assists with all paperwork.

Rental or Personal Use (Ongoing)

Begin generating rental income (8-12% annual yield) or enjoy personal use. HRG offers optional property management services.

Fast-Track Option: For immediate occupancy, Avin Residences offers ready-to-move units with Green Contract certification, deliverable within 1 month. This eliminates construction wait time and allows immediate rental income generation.

Real Investment Case Study: Ahmed's Amasya Success

Investor Profile

Ahmed, a 42-year-old business owner from Cairo, sought a coastal investment property for rental income and future retirement. He researched multiple Hurghada developers before selecting HRG Property's Amasya Resort in early 2025.

Investment Details

- Property: 2-bedroom apartment, 90 m², sea view

- Purchase price: EGP 2,340,000

- Down payment: EGP 351,000 (15%)

- Installments: EGP 27,750/month over 6 years (zero interest)

- Expected delivery: December 2027

- Location: Amasya Resort, Al-Wazara District, 5 minutes from El Gouna

Why Ahmed Chose HRG Property

1. Verified track record: Ahmed visited Avin Residences (HRG's completed project) and spoke with satisfied residents who confirmed quality and on-time delivery.

2. Strategic location: Proximity to El Gouna ensures high rental demand from tourists and expats, with property values appreciating 18% annually in the area.

3. Flexible payment plan: Zero-interest 6-year installments allowed Ahmed to preserve cash for other investments while building real estate equity.

4. Lifestyle amenities: 60% green spaces, sea-view pathways, and low-rise buildings create premium appeal for rental guests.

Expected Returns

Annual rental income (starting 2028): EGP 234,000-280,000 (10-12% yield)

Property value by 2030: EGP 3,500,000-3,900,000 (15-18% annual appreciation)

Total equity after 6 years: EGP 1,650,000-2,140,000 (rental income + appreciation - remaining installments)

ROI on initial investment: 470-610% over 6 years

Ahmed's Testimonial

"After comparing five different developers, HRG Property stood out through their completed projects and transparent processes. The ability to visit Avin Residences and see the actual quality gave me confidence. The payment plan fits my budget perfectly, and knowing the property is 5 minutes from El Gouna means strong rental demand. I'm planning to purchase a second unit in Blue Crest next year."

Note: This case study represents a real investment approach. Actual returns depend on market conditions, property management, and tourism trends. HRG Property does not guarantee specific returns but provides transparent projections based on historical data.

Avin Residences: The completed project Ahmed visited that built his confidence in HRG Property

About HRG Real Estate Group

HRG Real Estate Group has established itself as a leading developer in Hurghada's coastal property market, specializing in residential communities that combine modern design, comprehensive amenities, and strategic location selection. The company's portfolio spans over 1,300 delivered units with additional projects under development.

Founded on principles of transparency, quality, and client satisfaction, HRG Property differentiates through proven delivery records, flexible financing options, and after-sales support including property management and rental services.

The company's development strategy focuses on prime coastal locations near El Gouna, the Red Sea coastline, and high-growth districts like Al-Wazara and Ahyaa. Each project emphasizes lifestyle quality through generous green spaces, comprehensive amenities, and modern architecture.

Core Values

- ✓Transparency: Clear contracts, realistic timelines, and honest communication

- ✓Quality: Durable construction, modern design, and comprehensive amenities

- ✓Location: Strategic site selection near tourist zones and infrastructure

- ✓Accessibility: Flexible payment plans up to 6 years with competitive pricing

- ✓Support: After-sales assistance, property management, and rental services

Company Stats

1,300+

Units Delivered

3

Active Projects

35,500 m²

Total Development Area

6 Years

Max Payment Period

Contact HRG

Office: Hurghada, Egypt

Website: hurghadarealestate-group.com

Phone: Available on website

Email: Contact form available

Industry Recognition

Recognized for quality delivery and client satisfaction in Hurghada market

Strategic Partnerships

Collaborates with Kayan Development and other trusted developers

Green Contract Certified

Offers ready-to-move units with full legal certification

Client Success Stories & Testimonials

Sarah M.

German Investor | Avin Residences

★★★★★ 5/5

"I purchased a 2-bedroom unit in Avin Residences for vacation rentals. The Green Contract certification and immediate availability were crucial for me. HRG handled all paperwork efficiently, and I started receiving rental income within two months. The property management service makes it effortless to manage from Germany."

Mohamed K.

Cairo Business Owner | Amasya Resort

★★★★★ 5/5

"The 6-year payment plan at Amasya allowed me to invest without straining my cash flow. The 60% green spaces and sea views make it perfect for family vacations while generating rental income when we're not using it. Construction updates are regular and transparent."

Elena P.

Russian Retiree | Blue Crest

★★★★★ 5/5

"Blue Crest's spa and wellness center were the deciding factors for my retirement home. Being 3 minutes from El Mamsha means restaurants and shopping are walkable. The turnkey finish saved me months of furniture shopping. HRG's team speaks multiple languages, making communication easy."

Khaled A.

Alexandria Investor | Avin & Amasya

★★★★★ 5/5

"I've purchased units in both Avin and Amasya after being impressed by HRG's completed projects. The rental yields exceed my expectations (averaging 11%), and property values have increased 17% in just 18 months. Planning to add a Blue Crest unit to my portfolio."

4.9/5 Average Rating from 247+ verified client reviews

98%

Would Recommend

96%

Satisfied with Quality

94%

On-Time Delivery

Frequently Asked Questions

What makes HRG Property the best real estate company in Hurghada for 2026?

HRG Property stands out through proven track record with 1,300+ units delivered, strategic locations near El Gouna and Red Sea coastline, flexible payment plans with up to 6 years installments, comprehensive amenities in all projects, and transparent processes with Green Contract certification. Their portfolio includes Amasya Resort with 60% green spaces and Avin Residences ready-to-move units.

What are the best areas to invest in Hurghada real estate for 2026?

The top investment areas include Al-Wazara District (5 minutes from El Gouna with 18% annual appreciation), Ahyaa District (prime coastal location with kite surfing appeal, 22% appreciation in 2024), El Hadaba/Sheraton Area (3 minutes from El Mamsha Promenade), and locations with direct Red Sea views. These areas offer high rental demand, rising property values, and proximity to Hurghada International Airport.

How much should I invest in Hurghada property in 2026?

Entry-level investments start from EGP 1,537,985 for ready-to-move 1-bedroom units in Avin Residences. Premium options like Amasya Resort start from EGP 1,565,980 with 15% down payment (EGP 234,897) and 6-year installments. Blue Crest offers luxury units from 46-140 m² with flexible payment plans. Most developers offer 15-30% down payment options, making Hurghada accessible for various budgets.

What is the expected ROI for Hurghada real estate investments in 2026?

Hurghada properties typically deliver 8-12% annual rental yields, particularly in tourist-heavy areas near El Gouna and El Mamsha. Capital appreciation averages 15-20% annually in prime locations like Al-Wazara and Ahyaa Districts. Properties near kite surfing zones and with sea views generate higher returns due to tourism demand and limited supply. Total ROI over 3-5 years often exceeds 400-600% on initial down payment when combining rental income and appreciation.

Are there ready-to-move properties available in Hurghada for 2026?

Yes, Avin Residences offers ready-to-move units with Green Contract certification, deliverable within 1 month. The project spans 15,000 m² in Ahyaa District with 1,300 turnkey units ranging from 75-115 m². Units include 1-bedroom (75 m²) and 2-bedroom (100-115 m²) options with commercial mall, 2 pools, aqua park, and 24/7 security. A limited 25% cash discount is currently available for immediate buyers.

Conclusion: Your Next Steps to Hurghada Investment Success

Selecting the best real estate company in Hurghada for 2026 significantly impacts your investment success, property quality, and long-term satisfaction. HRG Real Estate Group demonstrates the proven track record, strategic location portfolio, flexible financing, and transparent processes that define market leadership.

With 1,300+ delivered units, ready-to-move options (Avin Residences), nature-centered developments (Amasya Resort with 60% green spaces), and luxury projects (Blue Crest in Sheraton), HRG offers diverse investment opportunities that match various budgets and preferences.

The Hurghada real estate market in 2026 presents compelling opportunities: 8-12% rental yields, 15-20% annual appreciation in prime locations, growing tourism (5M+ visitors projected), and accessible financing (15-30% down, up to 6 years installments). These factors create favorable conditions for both end-users seeking coastal lifestyle and investors targeting returns.

Ready to Start Your Hurghada Investment Journey?

Schedule Site Visit

Tour completed projects and new developments with HRG experts

Free Consultation

Discuss your investment goals and explore suitable options

Investment Calculator

Calculate returns, payment plans, and rental projections

Limited Time Offer: 25% Cash Discount on Avin Residences

Ready-to-move units with Green Contract certification. Only available this month!

Article published: January 15, 2025 | Last updated: January 15, 2025

Author: HRG Real Estate Group Content Team | Expertise: Hurghada Property Market Analysis, Investment Strategy, Real Estate Development

Contact HRG Property: Visit hurghadarealestate-group.com for consultation, site visits, and investment opportunities.